Global eCommerce Trends for 2016

2015 is behind us and 2016 is already in full swing, which means eCommerce is front and center for U.S. and worldwide retailers. Global consumers’ demands for easy, creative and more personalized ways to complete online transactions is feeding an ever-growing market with no slowdown in sight. The key to continuing to successfully sell globally is understanding overall eCommerce trends and realizing that one size does not fit all, all markets are not created equal and country and region-specific differences need to be considered in order to keep expanding your global footprint.

A Quick Look at Years Past

If the last two years are a good indicator of things to come we have reason to be optimistic. The 2015 Global Retail E-Commerce Index™ underscored the reality that the world’s largest economies will continue to dominate the global eCommerce market due to their size. But, the report also shows that there are smaller markets, like Mexico, whose upward trends cannot be ignored. An increase in sales by over 20% to almost $840 billion is attributed to online retailers and traditional brick and mortar retailers seeking out new and emerging markets.

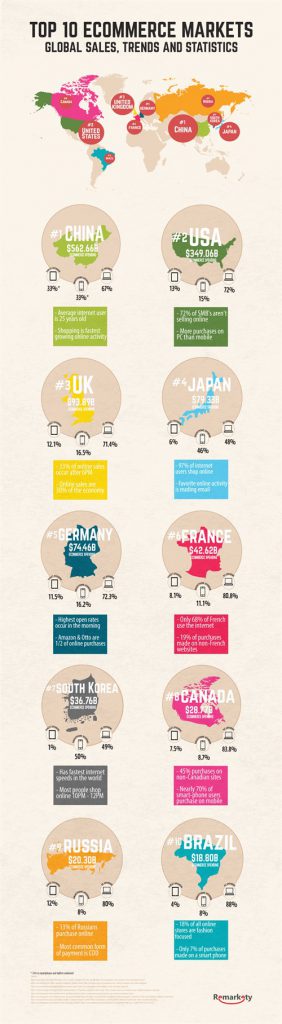

However, according to Remarkety, there seems to be a switch at the top as the graphic below displays. The graphic took a look at the top 10 eCommerce Markets in 2015 where China took the number one spot surpassing the U.S. in eCommerce spending. The U.K. and Japan still hold on to spots three and four.

Infographic Credit: Remarkety

Global eCommerce Predictions for 2016

2016 should show solid growth for eCommerce, but it is also important to note that not all regions will be following the same trends. A blog by Peyton Wiederspan on GetElastic outlined five major global eCommerce trends we should be paying close attention to.

- U.S. eCommerce: eCommerce on mobile devices will account for 22% of all eCommerce sales, influencing one trillion online retail transactions. Mobile devices are used more and more for conducting initial research, checking availability and seeing if there is a location near them to complete the purchase.

- Mexico’s rapid growth rate is quite impressive as the statistics for 2015 (30%) and 2014 (32%) show. But as impressive as those numbers may be, eCommerce transactions only account for about 1.5% of all retail in Mexico. A 2013 Comscore study identified two major drivers of online shopping: free shipping and a variety of payment options. In the study, 53% of shoppers interviewed said that they only bought more items in order to qualify for free shipping and the major reason for shopping cart abandonment was the lack of their desired payment option.

- Canada has a higher eCommerce growth rate (17%) than the U.S. and the U.K. (both around 14%) and its eCommerce market will hover around 70% market penetration and is expected to stay close to that number for the next few years. A general trend Canada shares with its North American neighbor is the usage of mobile devices for purchases and research and the expectation of a more flexible omnichannel repertoire that retailers need to become more sensitive to in order to retain their customer base and expand upon it.

- The eCommerce market and internet penetration in Europe has enjoyed exceptional growth since the beginning of 2000 with the number of internet users up by 275% and now making up a quarter of all internet users, globally. In the U.K., online sales now account for 20% of all sales and France and Germany are not far behind. Speaking of European powerhouses, the British and French list their number one requirement for making an online purchase as product comparison. The Spanish and Germans on the other hand value fast checkout more than anything else. Overall Europeans would like the option to buy online and then return to a physical store, or see a product in an actual store and then buy online which helps explain why some companies are going brick-and-mortar especially in the apparel industry.

- In Asia a certain segmentation is necessary to understand different markets, which can vary widely. Focusing on China, India and Japan, Peyton’s article showed some distinct differences per country when looking at the “big three”.

- China: Although the Chinese consumer is not making many purchases throughout the year more that 35% will make at least one purchase a year online. That may not sound like a lot but there is strength in numbers as this translates to over 400 million online shoppers; twice as many as in the U.S.

- India: Despite the ongoing challenge of internet penetration among Indian households, currently 9% of the population is purchasing online and not surprisingly 40% of all online transactions are done on smart phones. That rate is very similar to China’s at 50%.

- Japan: Japanese consumers still rely heavily on the PC as their preferred method of conducting their online purchases and although more than 69% of the population will own a smart phone in 2016 only about 23% of online shoppers say they will use it for online shopping.

There are, however, some bumps in the road for several countries when it comes to eCommerce growth, such as South Korea, who saw its eCommerce sales growth slow down compared to other countries. South Korea still remains a leader in the online engagement and enjoys a solid infrastructure in terms of its financial and logistical state of affairs. More troubling are the developments in Latin America where Brazil and Argentina fell steeply in the index due to ongoing challenges with infrastructure in Brazil and heavy governmental regulations in Argentina. This could prove to be hindering factors to solid and steady eCommerce growth.

Conclusion

A report by ATKearney correctly stated there are some common themes that can be observed in eCommerce: the rise of eCommerce IPOs. There is a need for an omnichannel strategy, adjusting to the “continuously connected consumer”, and not surprisingly, internationalization. With online payment options becoming more secure, international fulfillment improving and companies such as Borderfree helping with customs and currency conversions, even brick-and-mortar retailers realize that eCommerce is the fastest way to expand their business. But global retailers must remember the mantra “the key to success when going global is localizing the online presence while also maintaining a unified global brand.”

Further Resources on Translation Service for eCommerce Companies

GPI has provided language translation services to eCommerce and e-retailer clients worldwide. In addition, GPI has developed a user-friendly Translation Services Portal that makes it extremely easy for non-technical users in the eCommerce arena to manage website, catalog and other eCommerce content translations projects.